News / Events

Spring Function

Splitsville In Woodbridge!

Our OLOA members had a great Spring Event this year. Our Sponsors provided some fantastic door prizes! Here are some pictures from the event.

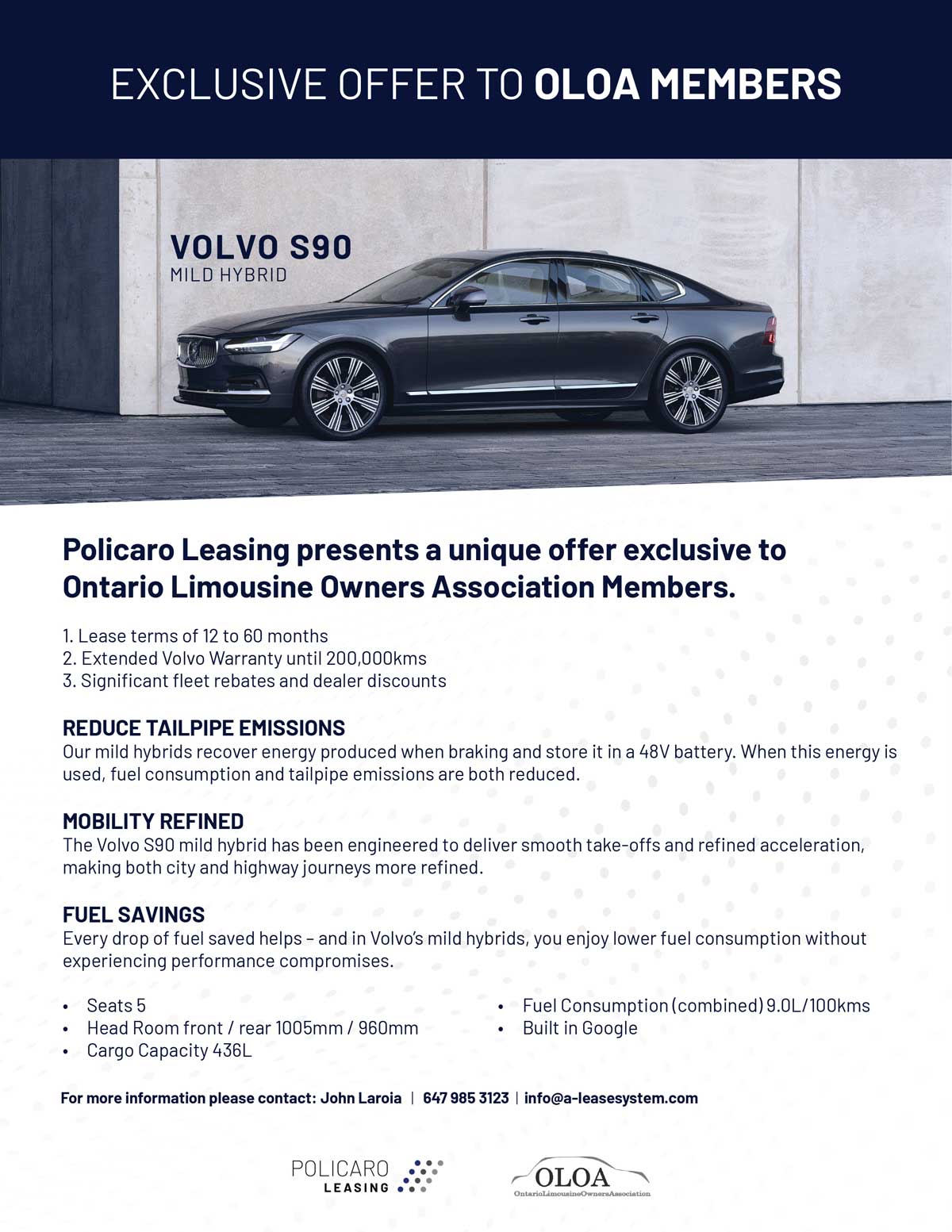

Policaro Leasing - Offer

GM Competitive Assistance Program

BIG NEWS!! The O.L.O.A. board is pleased to announce that GM is offering all O.L.O.A. members SIGNIFICANT SAVINGS for the following vehicles:

2025 Models:

New Models Added to the Program:

- Cadillac Escalade

- Cadillac Escalade ESV

- Chevrolet Suburban

- Chevrolet Tahoe

- GMC Yukon

- GMC Yukon XL

GM Disclaimer:

- O.L.O.A. member intending to acquire one of the above models must obtain an approved authorization letter from the O.LO.A. board. Member must bring completed and signed letter to GM dealership of choice to complete purchase/lease transaction.

- These incentives are not compatible with any other GM Fleet or retail programs.

- The vehicle(s) must be registered in your company name and retained for a minimum of 6 months and 12,000 kms.

O.L.O.A. Disclaimer:

- This GM incentive program is exclusively for Ontario Members.

- New Members are required to pay two year membership in advance in order to qualify for the GM incentive program.